Budget¶

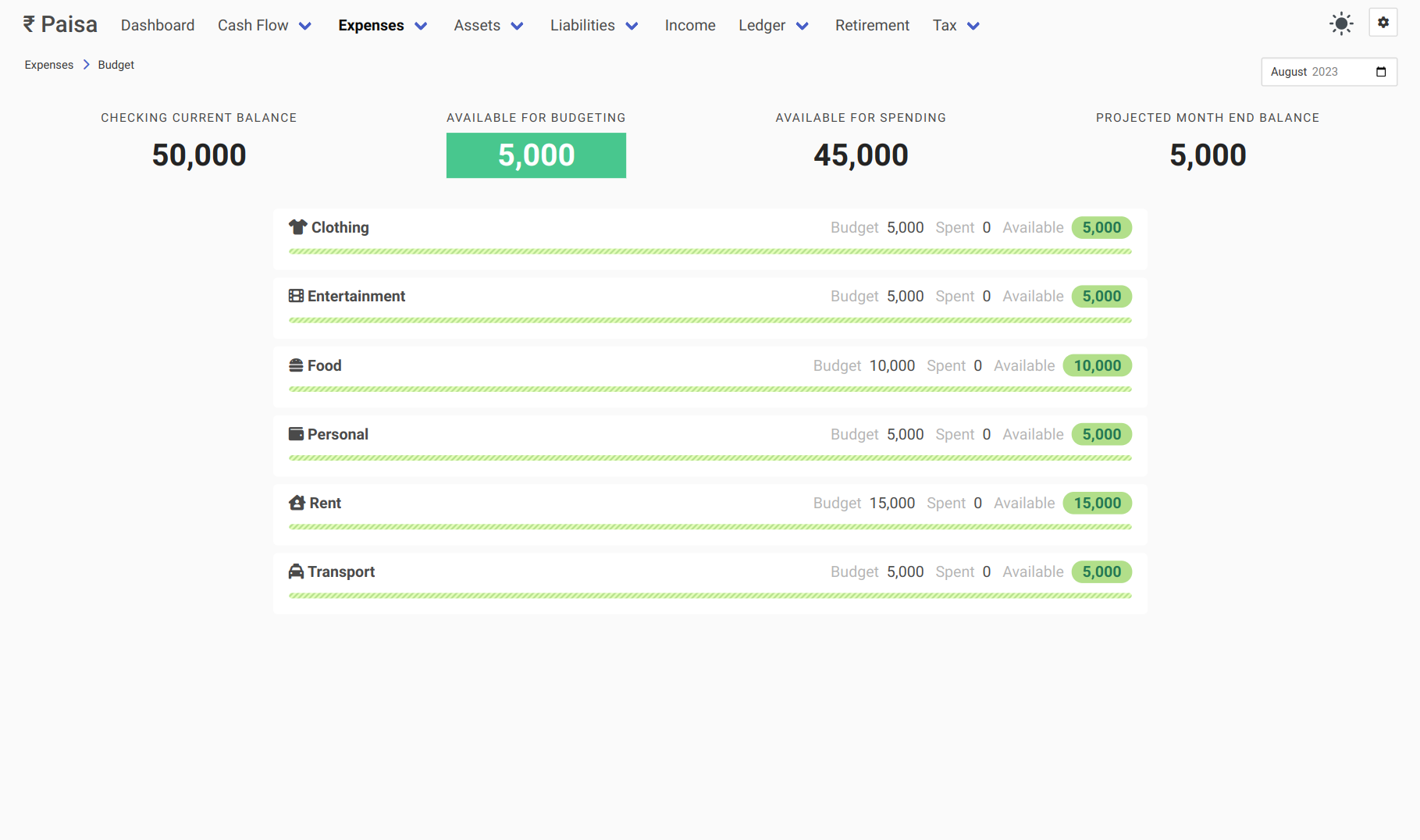

Paisa supports a simple budgeting system. Let's say you get 50000 INR at the beginning of the month. You want to budget this amount and figure out how much you can spend on each category.

Let's add a salary transaction to the ledger:

Now you have 50k in your checking account. Let's budget this amount:

~ Monthly in 2023/08/01

Expenses:Rent 15,000 INR

Expenses:Food 10,000 INR

Expenses:Clothing 5,000 INR

Expenses:Entertainment 5,000 INR

Expenses:Transport 5,000 INR

Expenses:Personal 5,000 INR

Assets:Checking

The ~ character indicates that this is a periodic transaction. This

is not a real transaction, but used only for forecasting purposes. You

can read more about periodic expressions and periodic transactions.

Bug

Even though the interval part is optional as per the doc, there is a

bug in the ledger-cli, so you can't use ~ in 2023/08/01,

instead you always have to specify some interval like ~ Monthly in 2023/08/01.

Now you can see that you will have 5k left in your checking account at the end of the month, if you spend as per your budget. Before you spend, you can check your budget and verify if you have money available under that category.

Let's add some real transactions.

2023/08/02 Rent

Expenses:Rent 15,000 INR

Assets:Checking

2023/08/03 Transport

Expenses:Transport 1,000 INR

Assets:Checking

2023/08/03 Food

Expenses:Food 8,500 INR

Assets:Checking

2023/08/05 Transport

Expenses:Transport 2,000 INR

Assets:Checking

2023/08/07 Transport

Expenses:Transport 3,000 INR

Assets:Checking

2023/08/10 Personal

Expenses:Personal 4,000 INR

Assets:Checking

2023/08/15 Insurance

Expenses:Insurance 10000 INR

Assets:Checking

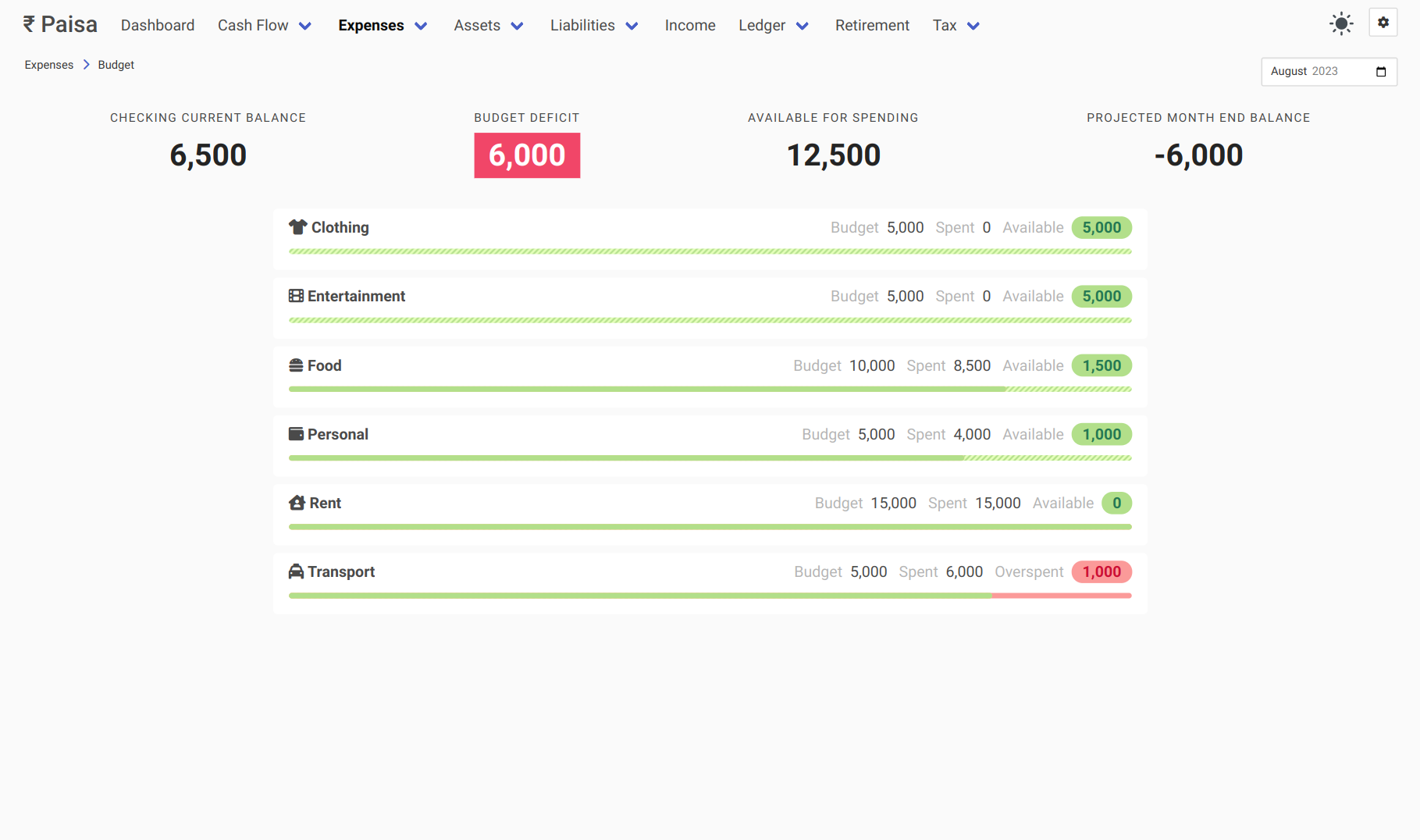

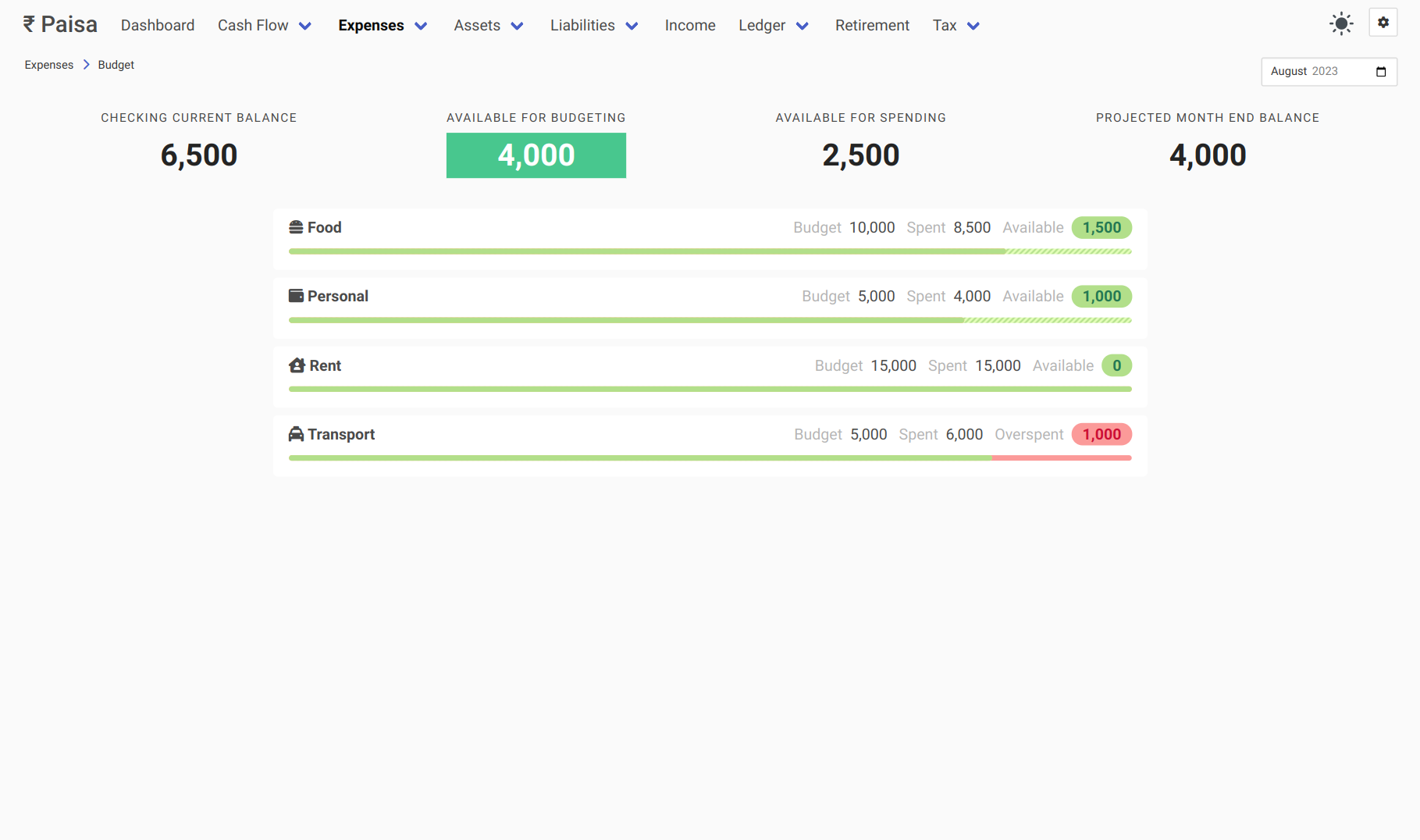

As the month progresses, you can see how much you have spent and how much you have left. You notice that you have overspent on transport and you have missed the insurance payment. You have a budget deficit now. That means, you can't actually spend as per your budget. You have to first bring the deficit back to 0. Let's cut down the entertainment and clothing budget to 0

~ Monthly in 2023/08/01

Expenses:Rent 15,000 INR

Expenses:Food 10,000 INR

Expenses:Clothing 0 INR

Expenses:Entertainment 0 INR

Expenses:Transport 5,000 INR

Expenses:Personal 5,000 INR

Assets:Checking

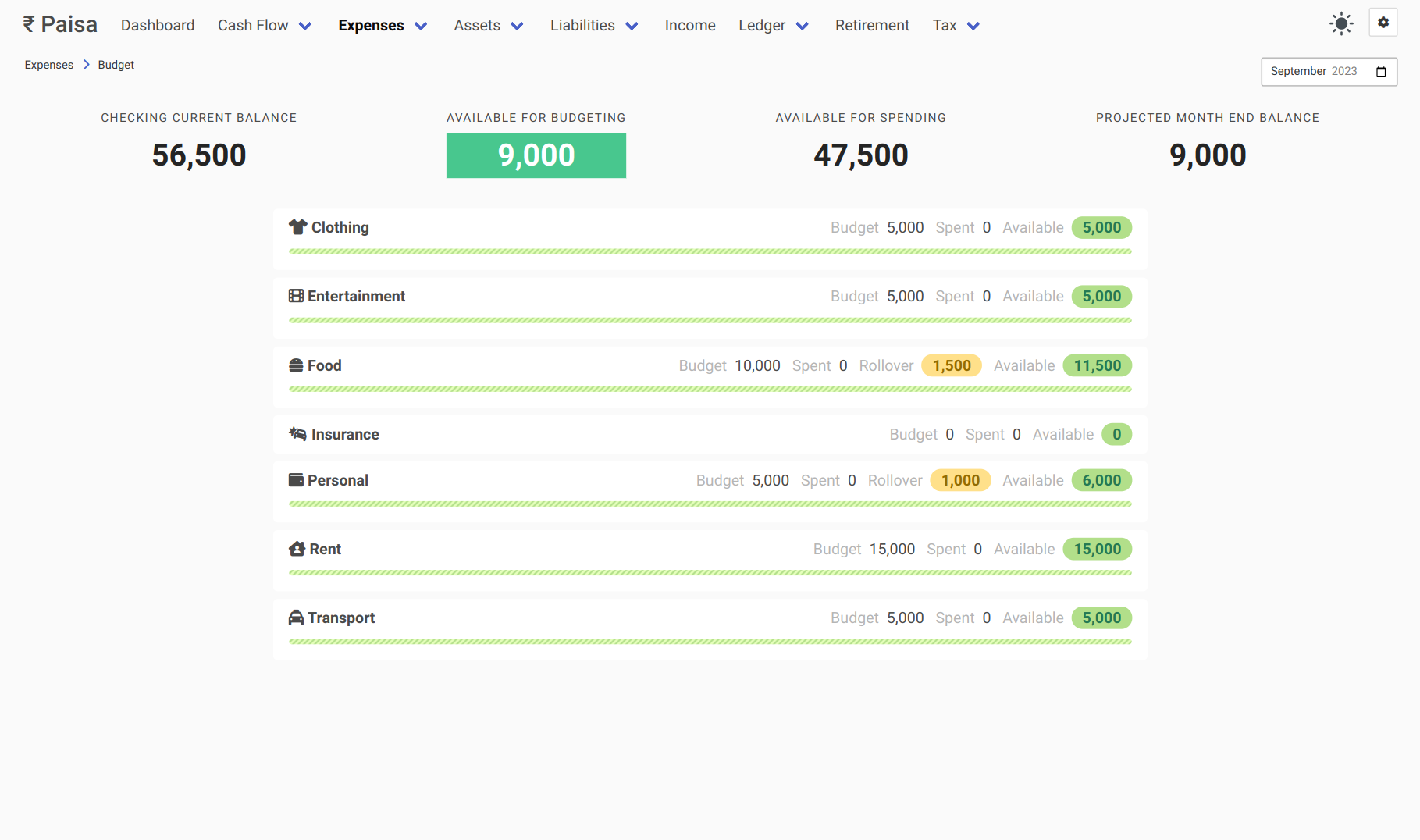

You can go back and adjust your budget anytime. Let's move on to the next month, assuming you haven't made any further transaction.

2023/09/01 Salary

Income:Salary:Acme -50,000 INR

Assets:Checking

~ Monthly in 2023/09/01

Expenses:Rent 15,000 INR

Expenses:Food 10,000 INR

Expenses:Clothing 5,000 INR

Expenses:Entertainment 5,000 INR

Expenses:Transport 5,000 INR

Expenses:Personal 5,000 INR

Assets:Checking

You can see a new element in the UI called Rollover1. This is basically the amount you have budgeted last month, but haven't spent. This will automatically rollover to the next month. That's pretty much it.

To recap, there are just two things you need to do.

1) Create a periodic transaction at the beginning of the month when you get your salary.

2) Adjust your budget as you spend and make sure there is no deficit.

-

If you prefer to not have rollover feature, it can be disabled in the configuration page. ↩