Sovereign Gold Bond¶

Reserve Bank of India started issuing a new type of bond called Sovereign Gold Bond (SGB) in November 2015. The bond is issued by RBI on behalf of the Government of India. Each unit of the bond is equivalent to a gram of gold. The price of the bond is linked to the price of the gold. The price is calculated by taking the average of the closing price of gold of 999 purity for the last 3 business days of the week. RBI follows the price of gold published by IBJA.

The bond also includes an interest component. The interest is paid every 6 months. The initial bonds were issued with 2.75% interest. Nowadays the interest is 2.5%. The interest is taxable as per the income tax slab of the investor. Any capital gains on the bond are exempted if you hold the bond till maturity. The bond has an 8 year term with an exit option available from the 5th year onward. In this blog post, we'll explore how to use Paisa to effectively track your SGBs and calculate your returns.

Let's assume you have 25,000 INR in your bank account.

Let's assume you bought 8 units of SGB issued on 26th

November 2015. The price of a single unit was 2684 INR.

2015/11/26 Buy Sovereign Gold Bond

Assets:Gold:SGB 8 SGB @ 2684.00 INR

Assets:Checking:SBI -21472.00 INR

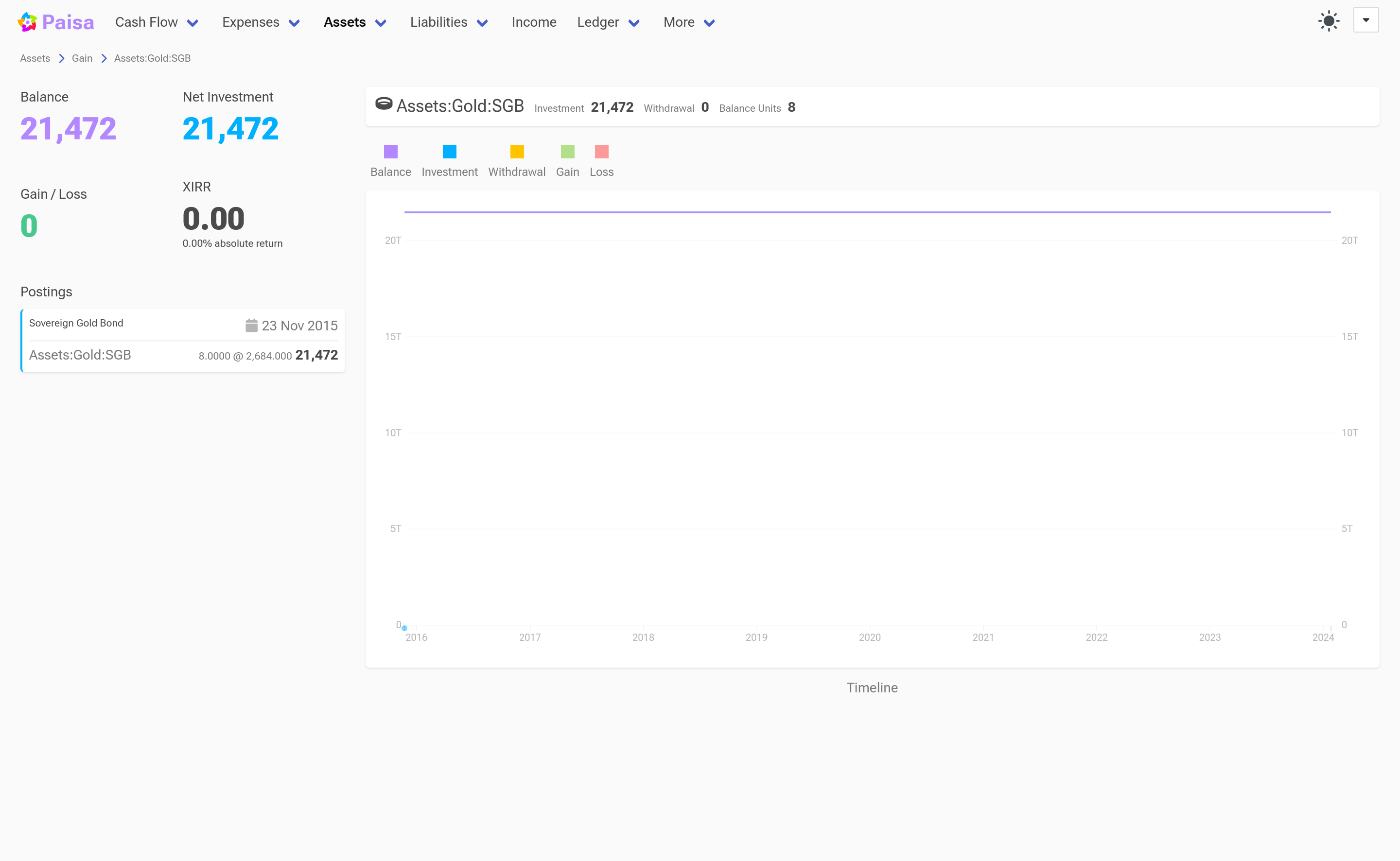

If you go to the Assets:Gold:SGB account, you'll see the

following

Let's add the interest component to the bond. The interest is paid on

26th of May and November every year. We need to make two

transactions entries for each interest payment. One from Income:Interest:Gold:SGB to Assets:Gold:SGB and another

from Assets:Gold:SGB to Assets:Checking:SBI. This is necessary to calculate the correct

returns. If you send the interest directly to your bank account, Paisa

will not be able to calculate the correct returns for Income:Interest:Gold:SGB account.

2016/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2016/05/26 SGB Interest Credit

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2016/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2016/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2017/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2017/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2017/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2017/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2018/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2018/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2018/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2018/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2019/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2019/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2019/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2019/11/26 SGB Interest Withdrawal

Assets:Gold:SGB 295.24 INR

Assets:Checking:SBI

2020/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2020/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2020/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2020/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2021/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2021/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2021/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2021/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2022/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2022/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2022/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2022/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2023/05/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2023/05/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

2023/11/26 SGB Interest Credit

Assets:Gold:SGB 295.24 INR

Income:Interest:Gold:SGB

2023/11/26 SGB Interest Withdrawal

Assets:Gold:SGB -295.24 INR

Assets:Checking:SBI

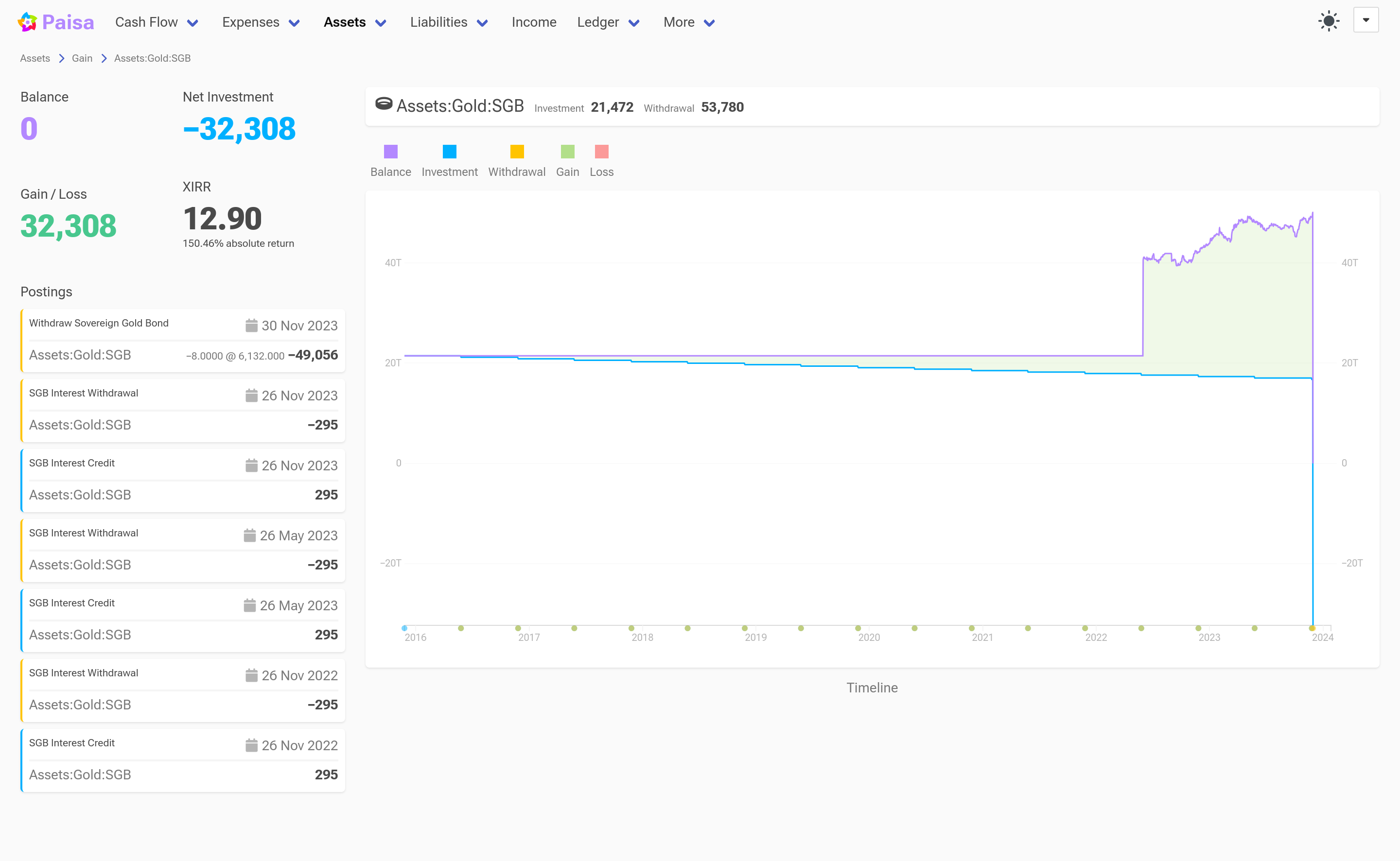

The final part is the bond settlement. The debit posting includes the buy price, buy date and the sell price. The gains come from the capital gains account.

2023/11/30 Withdraw Sovereign Gold Bond

Assets:Gold:SGB -8 SGB {2684.00 INR} [2015/11/26] @ 6132.00 INR

Income:CapitalGains:Gold:SGB -27584 INR

Assets:Checking:SBI 49056.00 INR

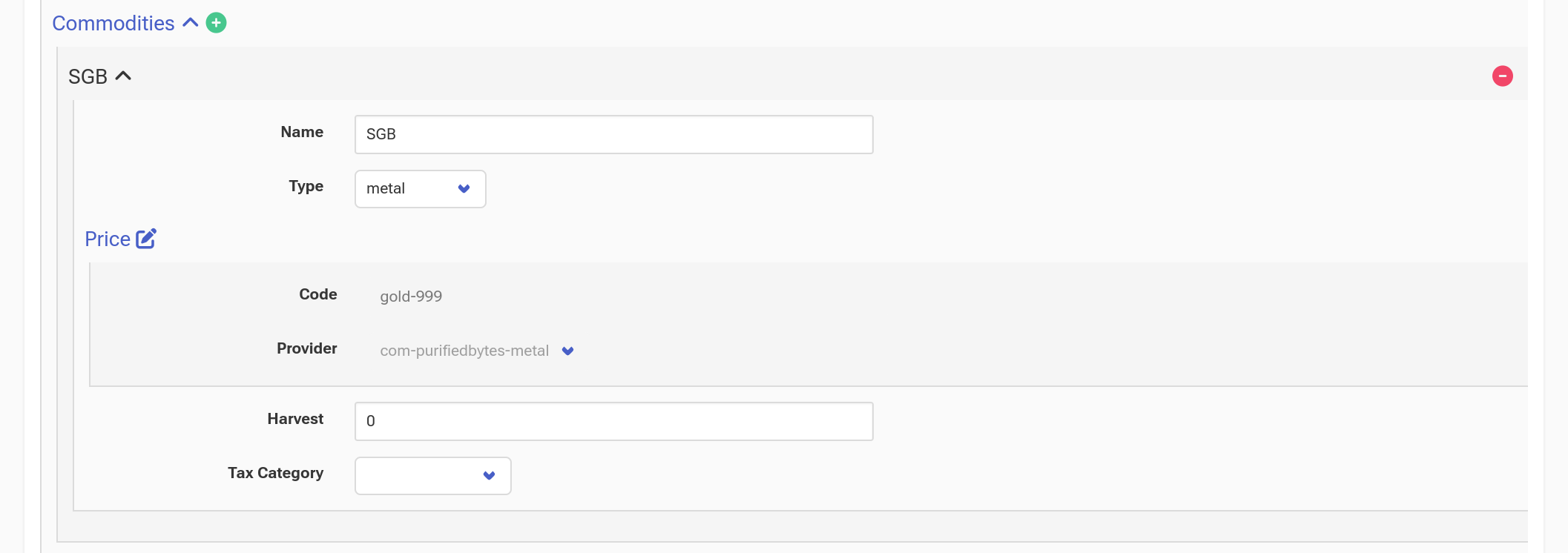

It's also possible to track the daily price1 of the bond. Since the bond price is linked to the price of gold, we can use the IBJA gold price to track the price of the bond. Go to the configuration page and add a new commodity with the following information.

If you go to the Assets:Gold:SGB account, You can find the

total returns, XIRR and the change of the bond value over time.

-

The daily price history of IBJA gold price is available only from 2022. If you have access to the price history, you can ping me. Alternatively, you can manually add the price history to the ledger file. ↩